Fair tax feasible but not recommended

Taxes will never be eliminated—at least not without annihilating the country.

Even the economist Adam Smith believed that. Smith knew taxes were necessary so the government could provide what the people would not otherwise procure—in other words, he wasn’t brainless on the topic or a libertarian.

But Smith also believed in another element of a tax system: simplicity. Today’s tax laws are increasing in complexity, and calls for simplification are being proposed to echo Smith’s canon. One such proposal is for a fair tax.

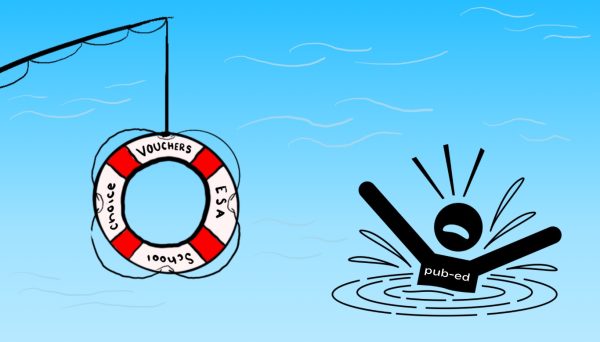

The fair tax proposal urges the complete elimination of the federal income tax and the replacement of it with a nationwide sales tax akin to a state sales tax. But instead of being added, the tax would be embedded. Thus, the price of goods would supposedly not rise.

This stability would be due to a combination of the elimination of payroll withholding and that of the tax only applying to the final sale. The final sale would be determined by employment type, much like current federal income tax forms. A final part of the proposal suggests a voucher system, analogous to a negative income tax, in which everyone receives a set amount of money.

There are positives. Foreign tourists would contribute more to the overall economy. Citizens would not necessarily earn more, but would not suffer from payroll withholding. Citizens would also not be punished for earnings and would have, in the long run, potentially more money to save or spend—a possible boon for the economy.

Furthermore, the fair tax would stop decisions based solely on tax considerations instead of best interest. And productivity could increase without having to conform to income taxation rules—not to mention the potential saving on accounting fees.

But these benefits are only under the most ideal of situations.

A more cynical look would say that the fair tax is potentially disastrous to the macrospectrum. Because the sole source of income for governments would be spending under fair tax, what if people simply stopped? The government may no longer have the wherewithal to provide for essential goods and services.

Businesses may not know what hit them, unprepared for the new tax rules. Not all is good in excess—if the fair tax encourages spending, it will encourage inflation as well. A new equilibrium in markets will establish itself again as it always does, but how long would this take? A month? A year? A decade? And would the transition leave the economy a shell of its former self?

The fair tax is a worthy cause, as simplification is needed for modern taxation. However, I cannot fully give my endorsement to such a system. The macroeconomic ramifications are too risky, despite the appeal of microeconomic gain.

The plan should not be dismissed entirely—if anything, it should be examined and learned from to better our current methodology of taxing. It won’t fix our problems, but it may help.