Trump tax plan profits the rich while hurting the poor

The rapid turnover of the news cycle while President Donald Trump is running the show causes us to miss things that otherwise would have dominated the national conversation. In just the past couple of weeks, Trump announced his new tax plan, cut subsidies to low-income purchasers of health insurance and encouraged the expansion of low-quality health care plans that do not provide for the needs of their customers.

None of these are surprising moves, and separately do not constitute an exactly outrageous misuse of presidential authority. However, when taken together, these actions – the tax plan in particular – represent one of the most egregious examples of the government working for the rich while disregarding the poor.

The government has been plagued by accusations of being a corporate lapdog at least since the Gilded Age, over 100 years ago, when oil and gas lobbies reigned supreme over American politics. The concentration of wealth was, at that time, reaching record levels of inequality, and the public took notice. Lawmakers were viewed as corrupted by monied influences and attacked as unrepresentative of their constituents. Today, some political commentators like Paul Krugman have compared our current situation with this troubled time in American history.

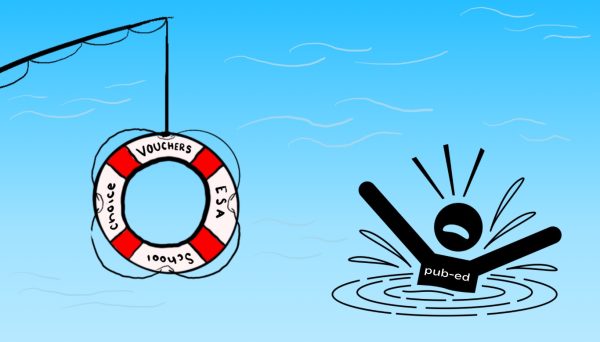

They’re exactly right. Trump’s tax plan is both an absurdly obvious gift to the wealthiest Americans and a disrespectful spite to the poorest. His plan reduces or eliminates many taxes on the rich and increases the burden of the middle and lower classes. By one analysis, Trump’s own family would have received savings of about $1 billion under the plan in one year.

The estate tax, which taxes large inheritances and was chiefly aimed at preventing the development of a landed aristocracy in the States, would be eliminated. So would the alternative minimum tax, the set amount of taxes a wealthy person must pay regardless of deductions. As for the middle class, the plan seeks to scrap most itemized deductions that would increase the amount of local and state taxes homeowners would pay overall.

The corporate tax rate would fall to a mere 20 percent, the lowest in decades. This last change has been a Republican rallying cry for years; they claim that by lowering the tax burden of corporations, jobs will be created and wages will rise thanks to the money they save. Despite this, a majority of Americans are actually in favor of raising, not lowering, the corporate tax rate, according to Pew Research Center.

This tax overhaul would only add to the burdens Trump has begun placing on low-income households. Just two weeks after it was announced, Trump ended subsidies to health insurers that help low-income families purchase insurance. In pursuit of their partisan war of attrition against Obamacare, Trump and Congressional Republicans are willing to essentially rob working class Americans of the insurance they only recently became able to obtain and simultaneously gift the wealthiest Americans with an increase in wealth none of them need.