Gamestop saga signals a new era for stock market

Courtesy of Carlos G. of Creative Commons

The incident with Gamestop’s stock was unprecedented, and Congress is already calling for new legislation to address the issues surrounding it.

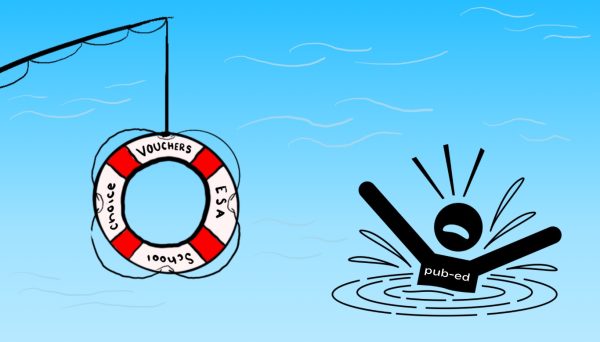

On January 28th, the stock market had a volatile frenzy thanks to Reddit community r/WallStreetBets. In 2019, a user named Keith Gill brought attention to the fact that several hedge funds were betting against video game retailer Gamestop. He encouraged many speculative investors, or gamblers, to drive up the company share price, which resulted in a year-to-date (YTD) increase of 1,500%. The struggling retailer’s share price peaked at $483 on the 28th, from a lowly $17 per share at the beginning of January. Since then, the balloon has popped with the company’s shares going down to $55 on Feb. 5. The surge caused massive losses for hedge funds that shorted the stock.

Trump’s presidency proved how the internet could distort reality beyond anything we ever imagined. Trump bent reality in 2016 by promoting fear-mongering lies about immigration and foreign policy. Now there’s no going back. In the past four years, thanks to the Trump Administration, the U.S has struggled to determine what is true and what is false. With Trump tweeting everything from Q’anon conspiracy theories to false claims about Hydroxychloroquine being a cure for COVID-19, trust in both the administration and the media was chaotic. While many lawmakers and Trump supporters were forced to abandon the web of falsehoods due to the events on Jan. 6, the spread of false information on social media platforms has turned to the world of finance. Now we’re seeing an internet field distortion in the financial markets due to social media.

The Gamestop saga symbolizes a new era for stock trading, an era where virtualism wins. The army of Redditors is the first instance of memes and social media overvaluing a stock in the name of screwing over hedge funds. In turn, it became a self-fulfilling prophecy for Reddit members in which a longshot falsehood quickly became a reality. Gamestop is one of the first examples of the separation between what a stock is worth and what people believe it’s worth has been based on perceptions of memes and other Reddit users rather than big money hedge funds.

The fiasco symbolizes a continuation of the Occupy Wallstreet movement of 2011 except this time it was effective. While many young investors took great joy in the fact that they were a part of the reason Wall Street hedge funds, such as Melvin Capital, lost billions of dollars, the internet engaged in a class war against Wall Street and won. Memes will continue to change reality and this gambit will likely be the first of many ploys against billionaire hedge funds in the near future. For Reddit, the Gamestop saga represented an opportunity to shift reality against the hedge funds and it shows how a new understanding of capitalism in the age of internet memes. Reddit realized that to win a rigged game, it must be rigged even harder through strength in numbers.