Steady tuition hikes may mean more student loans and debt

During presidential campaigns, observers often look for an “October Surprise” that can change the election. Unfortunately, St. Edward’s University has its own October surprise this year – another tuition hike.

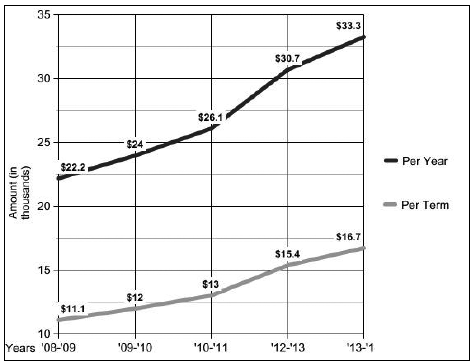

Next year’s tuition will be a painful $33,320, a 8.5 percent increase from this year. However, many students do not realize is that 8.5 percent is approximately the same increase as the last nine years in a row.

Including next year’s rise, students will have seen tuition rise $18,610 from ’03-04 to ’13-14, a 127 percent hike.

To be fair, the campus we have today is very different than the one that existed back in 2003. In 2003, the science building, Fleck, Fine Arts, Dujarie, Basil Moreau Hall, Doyle, Premont, Hunt, Le Mans and Johnson residential village were either not built or unrenovated, not to mention dozens of smaller projects.

Additionally, we were right at the national private university average of 28,500 in 2011-12, so the increases of previous years still left us with below-average tuition. However, students have two major concerns: lack of information about future rate increases and the way that financial aid and scholarships are set up.

As of now, tuition increases are not formally communicated to current students until it is time for the next fall’s registration, and there is no public future tuition outlook available to students and their families. If tuition continues to increase at 8.5 percent each year for the next five years, tuition in 2018-19 will be in the neighborhood of $50,000 a year. At exactly, $50,099.21 this number will surpass most private universities across the country.

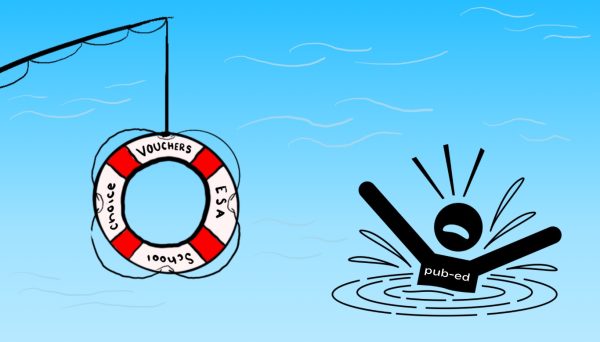

St. Edward’s student debt will continue to increase. Sixty-five percent of the class of 2011 left St. Edward’s in debt, with each debtor having an average debt load of $32,828, according to The Project on Student Debt, a nonprofit research organization. Nationally, two-thirds of graduates had debt with an average of $26,600 each in loans.

In addition, private college tuition in schools across the nation rose 29 percent from 2001 to 2011 as measured by College Board. These rising costs put a larger and larger burden on graduates.

According to the New York Federal Reserive, student loans passed credit card debt as the seconnd largest source of consumer debt last year by nearing $1 trillion dollars.

While the sticker tuition price may be posted online, most students do not pay that full amount. According to the university, over 87 percent of freshman receive grant or scholarship aid averaging $17,640 each.

However, what is not mentioned is that much of this aid does not increase with the price of tuition, meaning the amount of money students are expected to pay rises each year.

For example, if a student received an annual $10,000 scholarship as a member of the class of 2014, they needed to come up with an additional $16,084 for the 2010-2011 year.

However, that number jumps to $23,320 by the time of their senior year of 2013-14.

While students may have been prepared to pay that $16,084 as a freshman, they may not be able to handle the $7,236 extra as a senior.

With the costs of tuition rising steadily each year and no forthcoming relief from rate hikes or indexed financial aid, students need to ask hard questions about how they are going to pay for school, and how the school is using their money.