OPINION: New loan forgiveness announcement may open doors for future initiatives

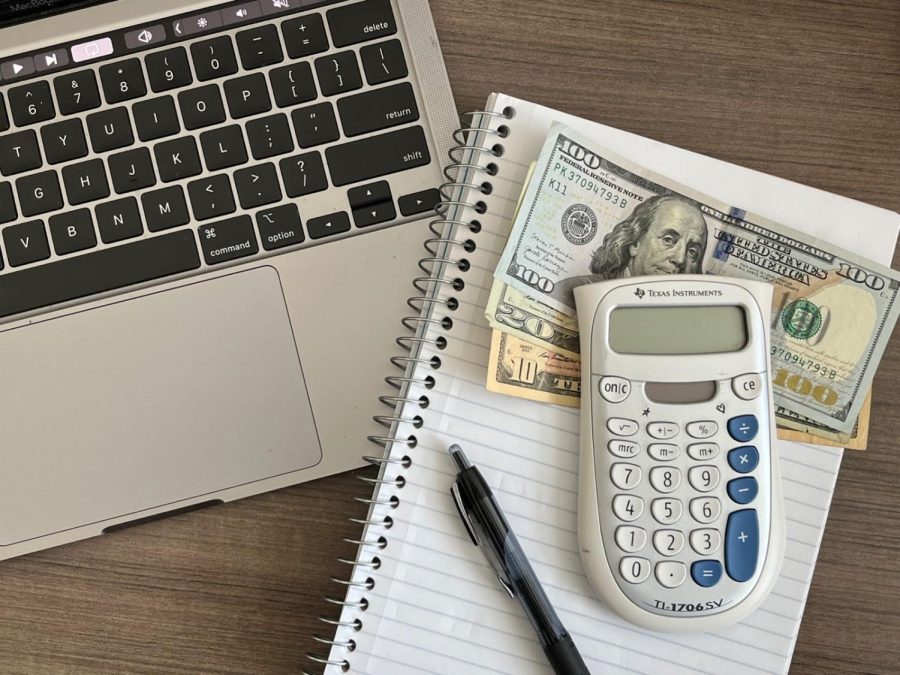

Chloe Almendarez / Hilltop Views

As graduation slowly approaches, accumulation debt begins to weigh down on students. Biden’s executive action would lift some of these financial stresses.

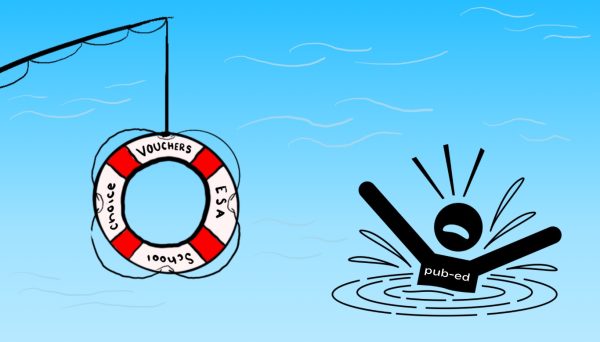

On Wednesday, Aug. 24, President Joe Biden announced an executive action that will provide student loan forgiveness of $10,000 for borrowers who make less than $125,000 a year and $20,000 for those who have received Pell Grants. Whispers of this plan have been circulating the nation ever since Biden’s campaign trail in 2020, when he proposed forgiveness of all federal undergraduate loans.

Currently, more than 45 million Americans have student loan debt, totalling a collective $1.6 trillion, with average borrowers graduating with $25,000 of debt. Biden’s plan aims to benefit working- and middle-class families so they may have the opportunity to buy a home, raise a family or start a business. Approximately 20 million borrowers will have their remaining balance cleared.

Since 1958, the federal government has been issuing student loans to help people pay for their college education. Attending institutions of higher education is one way people build wealth and create better opportunities for themselves or their families; however, the cost of attendance at four-year universities is typically more than what lower- or middle-class families can afford. That’s where student loans provide much-needed assistance.

Oftentimes, though, students taking out loans have trouble paying them back due to high-interest rates and financial instability. With stagnant wages, an increasing wealth gap and the pandemic-era job market, borrowers may have a difficult time beginning repayments when they resume at the start of next year.

Biden’s plan is a step in the right direction to help people all over the country establish financial stability and create a steady, debt-reduced future for themselves.

Prominent politicians Elizabeth Warren (D-Mass.) and Senate majority leader Chuck Schumer (D-NY), are among those who have advocated for forgiveness of a larger amount. In February 2021, Warren, Schumer and representatives Ayana Pressley, Alma Adams, Ilhan Omar and Mondair Jones reintroduced a previous resolution to urge President Biden to cancel up to $50,000 in student loan debt.

Critics of student loan forgiveness argue there are many drawbacks to Biden’s plan. The first being a potential increase in inflation, and second that it may encourage institutions to charge more for tuition or prompt borrowers to take out more loans. Most notably, critics claim it would be unfair to those who either didn’t go to college, already paid off their student loans or do not want their taxes to pay for others’ education.

While I do believe there is validity to these criticisms, I strongly endorse the President’s action to forgive student debt. For millions of people, this will relieve a financial burden that causes strain on everyday living and making ends meet. Those who have their loans completely cleared may be able to buy a home, provide for their families or pay back other debts.

For others like myself, who will still have a substantial amount to pay, we will continue to pay back the rest that we owe. Perhaps Biden’s action will set a precedent for future loan forgiveness or prompt politicians to introduce legislation combating ridiculous interest rates or high tuition costs.

While we wait for applications for forgiveness to roll out in early October, it is important to consider what student debt means for you and your fellow students. I urge you to be financially transparent and to have conversations with peers about how paying for college will affect you, people all over the country and what it means for a government to provide funds for education.

Chloe Almendarez is a senior Psychology major with a minor in Education Studies. This is their second year working with "Hilltop Views" as Managing Editor....